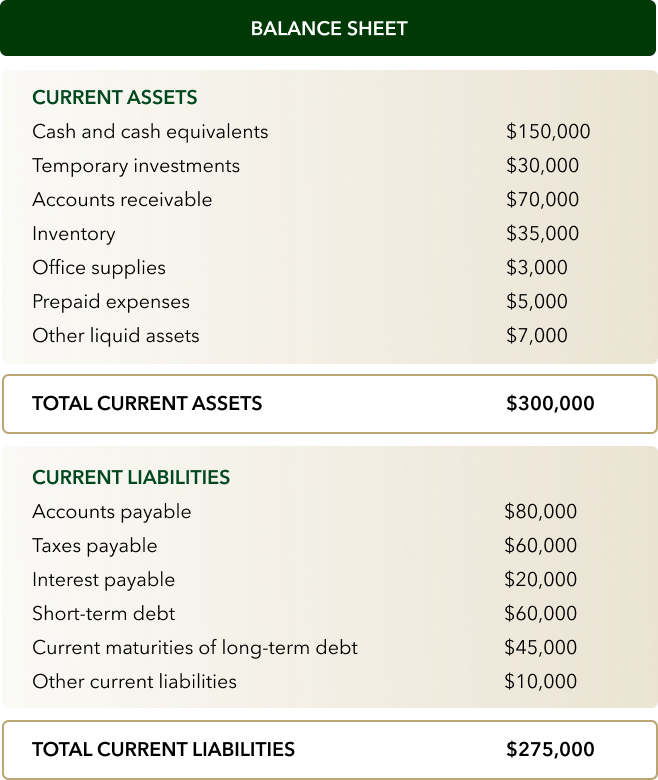

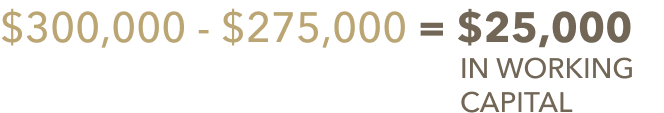

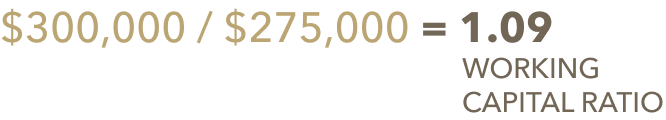

A net positive ratio (between 1.2 and 2) tells you that your business has adequate working capital. A ratio below 1.2, such as in our example, signifies that your business may have an insufficient financial cushion in the short term and could benefit from a boost in liquidity.

Finally, a negative ratio (lower than 1) indicates that the business is likely to experience difficulty paying back its creditors and, in most cases, must promptly address its working capital needs.

Common reasons to get a working capital loan

Businesses like the one in the example above require financing to ensure they have the working capital needed to support their daily operations and fulfill their short-term obligations. There are many reasons a business may not have adequate working capital. Here are the most common ones:

Late payments from customers

Cash flow is affected when customers pay late. A business must ensure that their accounts receivable operation is as streamlined as possible. Understanding that cash flow isn't always predictable, these businesses can benefit from a working capital loan.

Fluctuating sales

Liquidity varies for most companies. This is especially true for seasonal businesses, where sales are known to slow down during certain times of the year. Similarly, it’s common for other types of businesses to have to wait to see a return (such as those which need to purchase inventory that will not arrive for several months). A working capital loan can see a business through these waiting periods.

Sudden growth

An upshot in sales is usually a good thing—unless the company is unequipped to meet demand. To take advantage of an event like this, the company may need a working capital loan to purchase/fund the necessary resources to ramp up operations.

Unexpected opportunities

A lucrative opportunity may arise that a business is not prepared to meet. Sometimes, it requires an upfront investment that may not produce ROI for some time. To ensure a business owner can pursue a new venture while maintaining their primary operation, they may consider a working capital loan.

BHG is your solution for working capital

If your business requires additional working capital, BHG Money offers financing up to $500,0001,2 and terms of up to 12 years1—giving you a loan with affordable monthly payments. And with a flexible use of funds, you can cover multiple initiatives with one solution, from purchasing inventory to upgrading your security and technology to hiring an expert to optimize your firm.

Get started by using our online payment estimator to view your personalized loan estimate in seconds, without affecting your credit score.

You can also learn more about partnering with BHG to help your business thrive by checking out our Working Capital Loans page.

¹ Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant's credit profile. Finance amount may vary depending on the applicant's state of residence.

² BHG Money business loans typically range from $20,000 to $250,000; however, well-qualified borrowers may be eligible for business loans up to $500,000.

No application fees, commitment, or impact on personal credit to estimate your payment.

For California Residents: BHG Money loans made or arranged pursuant to a California Financing Law license - Number 603G493.