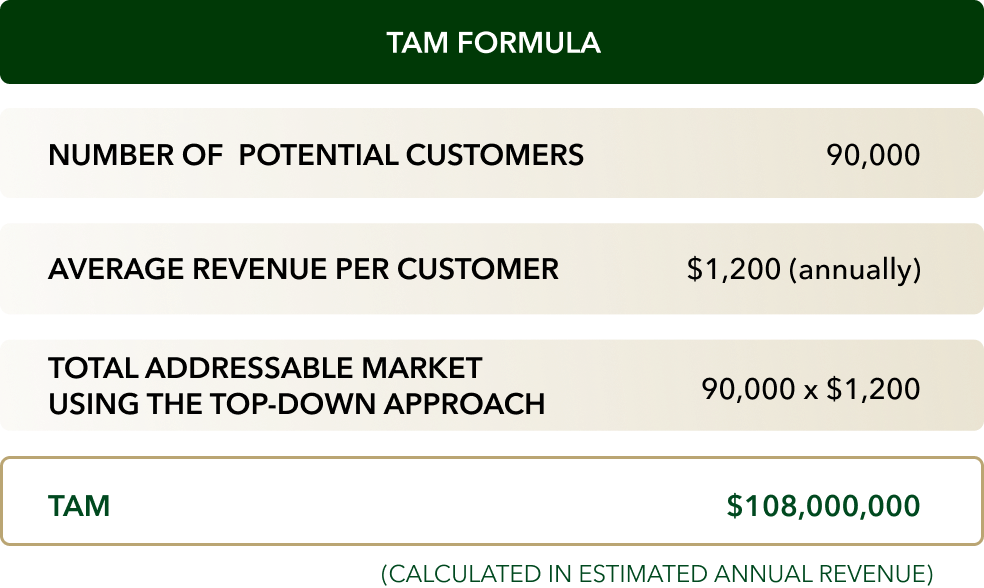

Remember that the medical spa must acknowledge their competition. With two other spas in the community, a TAM of $108MM will be shared with these other providers.

Other considerations

While TAM can help you formulate your business strategy, it should only be one of multiple resources in your toolkit. For the purpose of business expansion, for example, you should also consider these other factors:

Profitability—It’s important to take time to determine whether expansion will positively impact your business’ bottom line and whether that impact will be substantial.

The wants and needs of potential clients—Taking a look at your current offerings, you must evaluate how well they’ll serve your target audience.

Your competition—It’s common to have various competing businesses in your market. Be sure to consider how your business can or should differentiate itself from these other companies in order to secure an edge with your client base.

BHG Money can help you expand

Many professionals require additional funds to support their business acquisition, buy-in, or business expansion efforts. If you’re ready to move forward with your initiatives, BHG Money can provide you with up to $500,0001,2 and terms of up to 12 years,1 giving you a loan with affordable monthly payments. You’ll also have access to concierge service every day of the week.

Get started by using our online payment estimator to view your personalized loan estimate in just 30 seconds, without affecting your credit score.

Learn more about partnering with BHG Money to grow your business by checking out our Existing Business Investment Loans page. Or, if you’re a medical provider considering expansion, read about the ways you can use our Medical Practice Loans.

¹ Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant's credit profile. Finance amount may vary depending on the applicant's state of residence.

² BHG Money business loans typically range from $20,000 to $250,000; however, well-qualified borrowers may be eligible for business loans up to $500,000.

No application fees, commitment, or impact on personal credit to estimate your payment.

For California Residents: BHG Money loans made or arranged pursuant to a California Financing Law license - Number 603G493.