Ideas for expanding a veterinary practice

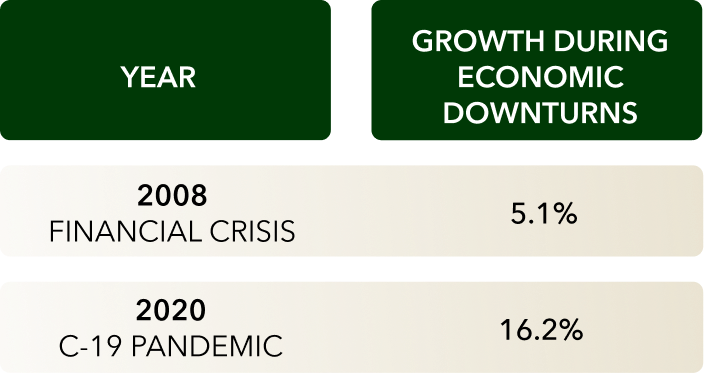

Now more than ever, veterinary practices are taking steps to keep up with the increased demand, accelerating their expansion timelines.

If you’re a practice owner who is considering expanding your current operation, we’ve prepared a list of ideas for you to contemplate as you determine the best path to growth:

- Adding square footage, including exam rooms, operating suites, studio apartments for doctors who need rest between shifts, etc.

- Constructing a wing for pet boarding

- Adding new services such as a pet retreat and spa

- Remodeling an existing location and/or enhancing facilities with state-of-the-art features, such as a rehab pool, an underwater treadmill, etc.

- Enhancing boarding suites by adding flat-screen TVs for continuous enjoyment and enrichment, as well as cameras with online streaming so owners can see their pets while they are away

- Building a separate room for pet acupuncture to treat muscle injuries

- Adding (or expanding) an onsite pharmacy

- Enhancing outdoor spaces by installing shaded patios with misters and artificial turf fields

- Purchasing a plot of land to start another location

You’re likely familiar with some or most of these types of expansions given that they’re taking place across the industry. But we encourage you—with this list in mind—to conduct your own thorough evaluations to determine how you can stay competitive, foster growth, and capitalize on heightened demand.

Veterinary practice loans for expansion

Of course, these types of investments—additional square footage, facility upgrades, and new equipment—require significant capital.

Many practice owners are taking out veterinary practice financing to fund these much-needed expansion projects, and some are consolidating debt (including their student loan debt) as they borrow additional funds.

Since 2001, BHG Money has served over 70,000 healthcare professionals, including many veterinarians, providing over $6B in funded loan solutions.

We provide highly specialized commercial financing up to $500,0001,2 with repayment terms of up to 12 years1 and dedicated concierge service 7 days a week. Compared to other veterinary practice lenders, our loans are designed to support every stage of your practice with flexible-use financing that’s customized for your goals.

Visit our payment estimator to see an obligation-free loan estimate in 30 seconds.

¹ Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant's credit profile. Finance amount may vary depending on the applicant's state of residence. Call for complete program details.

² BHG Money business loans typically range from $20,000 to $250,000; however, well-qualified borrowers may be eligible for business loans up to $500,000.

For California Residents: BHG Money loans made or arranged pursuant to a California Financing Law license - Number 603G493.

No application fees, commitment, or impact on personal credit to estimate your payment.