Generating income passively has been a topic of conversation in recent years, with many blogs offering ideas and news articles showcasing success stories. Notably, passive income—earnings that are generated from a source other than salary earned from formal or contract-based employment—is seen as a tool for achieving financial freedom.

For tax purposes, the IRS offers a definition for passive income that everyone who is operating in this space should recognize.

According to IRS Publication 925, there are two forms of passive activities:

- Trade or business activities in which you don’t materially participate during the year

- Rental activities (even if you do materially participate in them, as long as you’re not a real estate professional)

How is “material participation” measured?

As defined by the IRS, material participation occurs when a taxpayer is involved in a business on a “regular, continuous, and substantial basis” during the year. A series of tests is offered in Publication 925 for you to make that determination, with the leading question addressing the number of hours of participation.

Material participation: a business investment example

Income generated from a business investment opportunity can be classified as either active or passive, depending on the investor’s involvement.

Let’s assume that you put $250,000 into a mom-and-pop restaurant with the agreement that the owners would pay you a percentage of their earnings. You have entered into a limited partnership (LP) with the general partner who oversees and runs the business. As long as you do not partake in operations in any meaningful way (other than investing the funds), any earnings would be considered passive income by the IRS.

However, if at any point you become involved in managing the restaurant and “materially participate” along with the general partner, then your income will be considered active.

Material participation: a real estate example

Per tax code, rental activities do not follow the same categorization as trade or business activities. Unless you’re a real estate professional, rental activities are considered passive income even if you do materially participate in them.

Note: Income from leasing land does not qualify as passive. For a land lease, where the only asset (or majority of the property) is the land, the income from a passive activity is going to be recharacterized as non-passive income. One such example would be leasing land to a parking lot operator.

We recommend that you consult a tax professional to learn more about your specific tax situation.

Is passive income taxable?

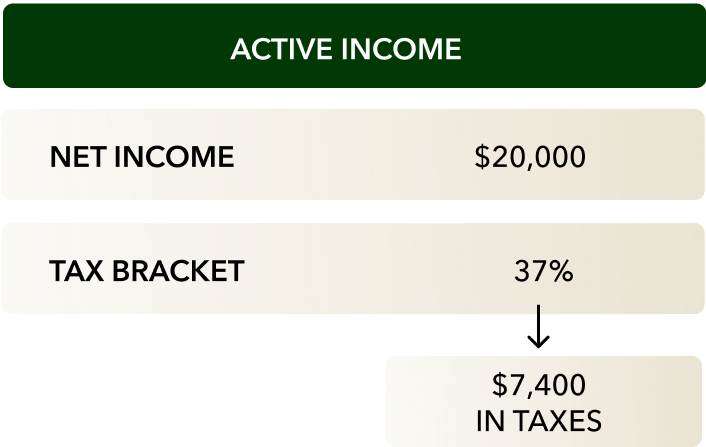

As with active income, passive income is usually taxable, but it is often treated differently by the IRS. While active income is typically taxed according to your normal income tax bracket, passive income taxes can vary depending on how the income is generated. In some instances, the tax rate on passive income can be more favorable.

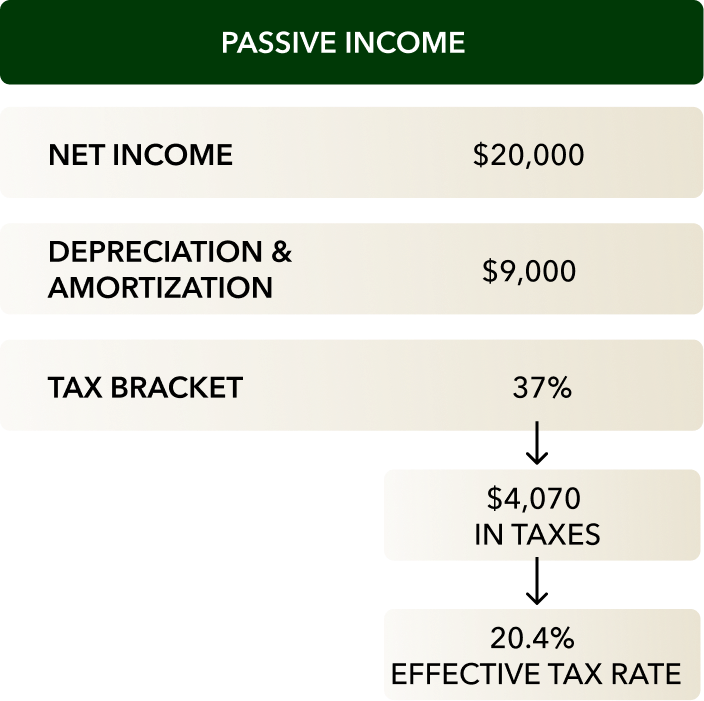

Let’s use the real estate example and assume that you own a rental property that nets $20,000 before depreciation and amortization. After applying $9,000 in depreciation and amortization, you are left with $11,000 in net taxable income. If you are in the 37% tax bracket, you will pay $4,070 in taxes, or an effective tax rate of 20.4%.