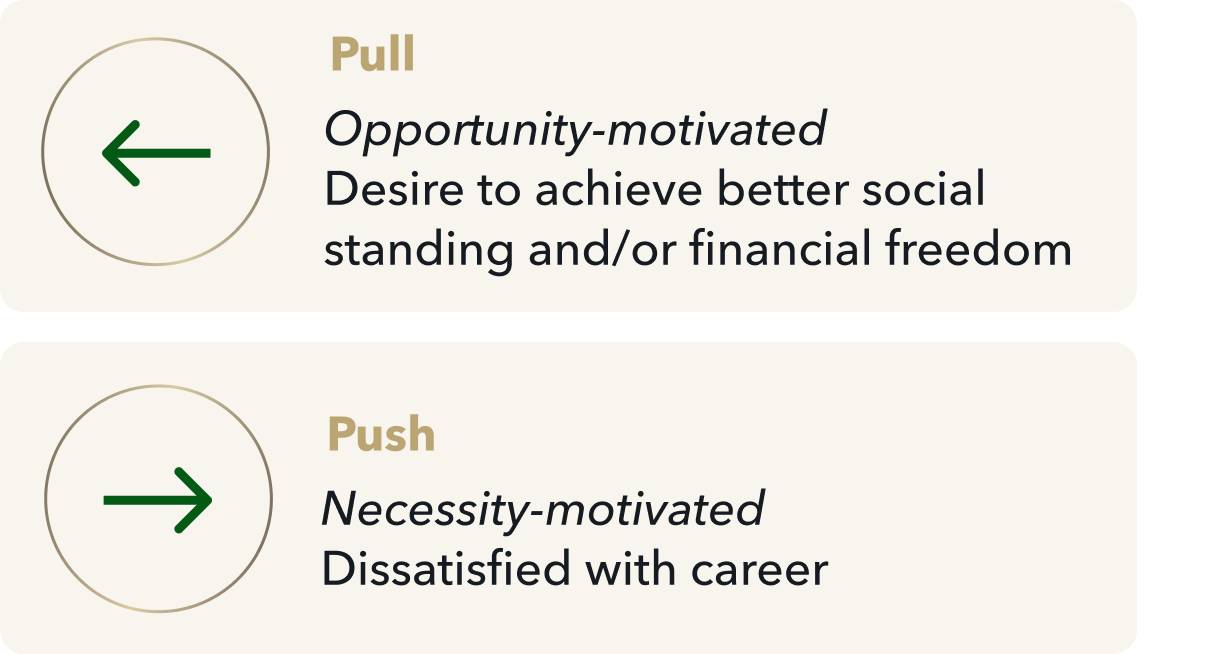

Some individuals fall exclusively into one of these categories, while others may be motivated by a combination of both pull and push factors.

It is important to understand what motivates you so that you can approach a new business opportunity in a way that will lead to success.

Are you motivated by opportunity?

If so, you are likely striving to achieve innovation, recognition, financial freedom, self-realization, or a combination of these factors.

As you embark on this journey, we encourage you to test the waters—start out small and see what kind of interest your new side project or part-time venture will generate. And, keep in mind, if you dedicate time and resources to develop it properly at inception, it is more likely to lead to a full-time commitment in the future.

In any case, we caution you against tying personal value to the value of your new business opportunity. As business starts to take off, it’s natural to get swept up in success. However, the world of small business is not for the faint of heart—it comes with many challenges and failed goals, which become evident sometime after the initial launch.

Helpful tip: It’s easier to obtain financing if you remain employed full-time as you start and ramp up your new project. Lenders are held to high underwriting standards: they are responsible for protecting their institutions against delinquencies and charge-offs. To increase the likelihood of approval and to maximize the amount that you can borrow, you must be prepared to demonstrate financial strength and the ability to repay debt—and a steady income stream and full-time employment status will go a long way.

Are you seeking a new business opportunity out of necessity?

Perhaps you feel trapped in your current role, bothered by a lack of autonomy. Or, maybe you’re looking for greater flexibility (i.e., work from home), improved work-life balance, or higher income to cover unexpected expenses. Whereas the previous section related to desire (“pull”), these other highly respectable reasons to pursue new business opportunities are more closely related to necessity (“push”).

As you begin to consider your options, we encourage you to seek out innovative ideas. Be proactive and competitive. Through thick and thin, stay optimistic and persistently make strategic moves to achieve success.

A frequent stumbling block for many is the lack of formal direction from someone with greater experience. In a professional setting, there are responsibilities that you must fulfill and a superior who formally evaluates your performance and holds you accountable. As you work on getting your side project off the ground, you must be the one to enforce the highest standards and perfect the skill of self-checking.

Also, just as we emphasized in the section above, it’s important to remember that financing for a new business opportunity is more easily obtainable if you remain employed full-time.

Closing remarks

You’ll likely face challenges as you pursue your new business opportunity—but you’ll just as certainly find the end result worthwhile.

As a lender who’s worked with individuals of various industries and experience levels since 2001, we understand your motivations and can provide you with flexible financing that helps you achieve your goals.

We offer loans up to $500,0001,2 and pride ourselves on providing dedicated concierge service throughout the funding process. Further, our repayment terms of up to 12 years1 give you affordable monthly payments that you can cover with earnings from your primary employment, particularly during the most critical times as you launch and ramp up your new venture.

View your personalized estimate online with no commitment.

¹ Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant's credit profile. Finance amount may vary depending on the applicant's state of residence. Call for complete program details.

² BHG Money business loans typically range from $20,000 to $250,000; however, well-qualified borrowers may be eligible for business loans up to $500,000.

For California Residents: BHG Money loans made or arranged pursuant to a California Financing Law license - Number 603G493.

No application fees, commitment, or impact on personal credit to estimate your payment.