Of course, every business is unique, and each company will have different growth options with varied returns. So, be sure to evaluate the effectiveness of any potential opportunity when deciding to postpone the repayment of your debt.

Let’s talk about total interest

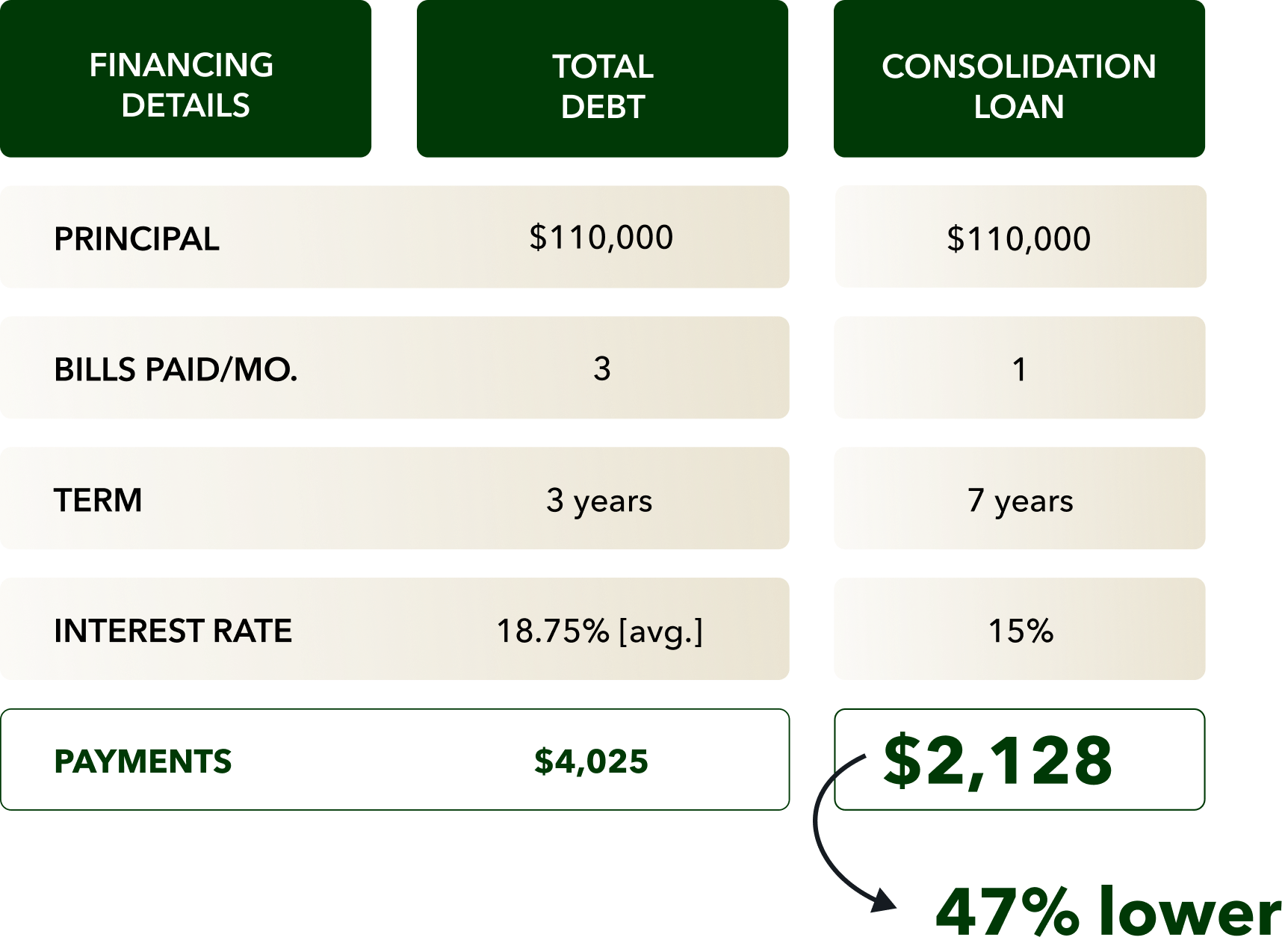

Unfortunately, there’s no way around it. Extending your repayment term will result in you owing a higher amount of total interest over the life of the loan. In our example, total interest owed increased from $35,000 for a 3-year term to $69,000 for a 7-year term at the time of debt consolidation.

That’s a significant jump.

However, the expected improvement in productivity, if achieved, will lead to more significant gross revenue gains—as we explained above, an increase from $600,000 to almost $800,000 in gross revenue on an annual basis.

That’s well worth an extra $34,000 in total interest. And this is just one way you can use debt strategically to achieve long-term financial goals.

The advantages of an extended-term1 loan from BHG Money

We understand that, as a business owner, you may prefer a longer repayment period to obtain lower monthly payments and more financial flexibility.

BHG Money offers terms of up to 12 years1 on loans up to $500,0001,2 with first-class concierge service every step of the way.

Get started online by viewing your personalized estimate today. Click here.

¹Terms subject to credit approval upon completion of an application. Loan sizes, interest rates, and loan terms vary based on the applicant's credit profile. Finance amount may vary depending on the applicant's state of residence. Call for complete program details.

²BHG Money business loans typically range from $20,000 to $250,000; however, well-qualified borrowers may be eligible for business loans up to $500,000.

For California Residents: BHG Money loans made or arranged pursuant to a California Financing Law license - Number 603G493.

No application fees, commitment, or impact on personal credit to estimate your payment.